Israeli Prime Minister Benjamin Netanyahu will land in Washington on Monday to far less fanfare than he would have expected just a day earlier. His highly-anticipated visit – chock-full of meetings with top US officials and a prized address to Congress – will now undoubtedly be overshadowed by US President…

General Min Aung Hlaing, leader of Myanmar’s military junta, became the country’s interim president on Monday after figurehead leader Myint Swe was placed on medical leave, state media reported. “The Interim President’s Office has sent a letter to the State Administration Council Office notifying it to delegate the responsibilities,” government…

The European Union’s next meetings of foreign and defense ministers scheduled in August will be moved from Budapest to Brussels, the bloc’s top diplomat announced Monday, in the latest escalation of a spat between the union and Hungary over its prime minister’s stance on the war in Ukraine. Hungary’s far-right…

Friday’s CrowdStrike software disaster has been described as “the largest IT outage in history,” and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn’t have a chance to look at the chart until this…

In this StockCharts TV video, Mary Ellen examines which areas of the market have moved into favor amid the S&P 500 pullback. She compares value vs. growth stocks and the merits of both, and highlights the move away from technology stocks. Which areas are poised for more downside? You can see…

In this edition of StockCharts TV‘s The Final Bar, Dave breaks down today’s upside recovery day for stocks, then shares the charts of TSLA, NVDA, and more. He also illustrates the conflicting messages from AAII and NAAIM sentiment surveys, and also highlights the VIX testing the key 15 level. This video originally…

Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come. You’ll be shocked to see the warning signs all over…

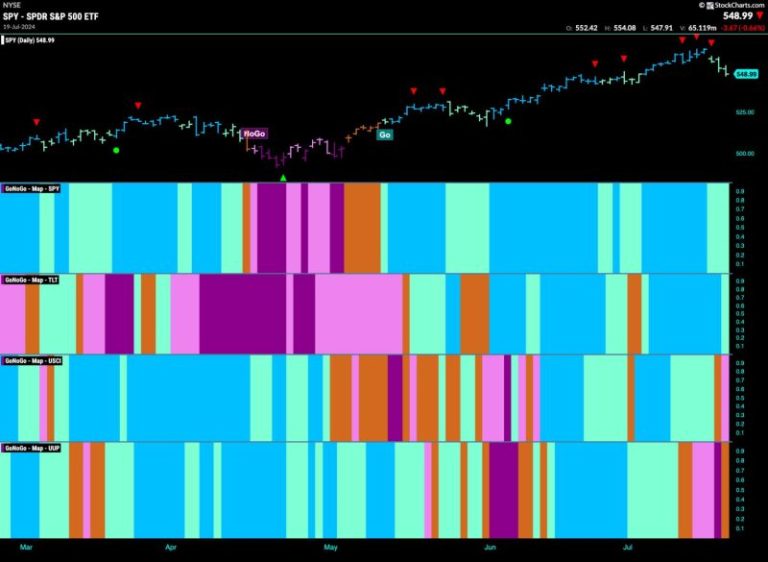

Good morning and welcome to this week’s Flight Path. We saw a lot of weakness this week but so far the “Go” trend has held in U.S. equities. GoNoGo Trend has reflected the weakness with a couple of aqua “Go” bars late in the week. Treasury bond prices showed a weaker aqua…

Australia federally legalised medicinal cannabis in 2016, and Australia’s cannabis market has seen major growth since then. Medical cannabis approvals were up by 120 percent in the first half of 2023 compared to the same period in 2022. Statista forecasts that Australian cannabis revenue will reach AU$3.73 billion in 2024…

Galloper Gold Corp. (CSE:BOOM)(OTC PINK:GGDCF) (‘Galloper Gold’ or the ‘Company’) announces it has entered into an agreement with MarketSmart Communications Inc. (‘MarketSmart’) pursuant to which MarketSmart will provide investor relations (IR) services to Galloper Gold for an initial term of 12 months Adrian Sydenham, President of MarketSmart, stated: ‘We are…