Jayapura, Indonesia — Gunmen stormed a helicopter and killed its New Zealand pilot shortly after it landed in Indonesia’s restive Papua region on Monday, and they released two health workers and two children it was carrying, police said. Glen Malcolm Conning, a pilot for Indonesian aviation company PT Intan Angkasa…

Prek Takeo, Cambodia — Cambodia broke ground Monday on a controversial, China-funded canal to link the capital Phnom Penh to the sea, despite environmental concerns and the risk of straining ties with neighboring Vietnam. The $1.7 billion, 180-kilometer (111 miles) Funan Techo canal is planned to connect the country’s capital…

Like many nondescript hotels in provincial cities around the UK, the Holiday Inn Express in Rotherham has been used for years by the British government to house asylum seekers trapped in administrative limbo. There have been hostile protests here before. But none, residents say, like the spasm of hatred on…

Israeli Finance Minister Bezalel Smotrich said “it may be just and moral” to starve 2 million Gaza residents until Israeli hostages are returned, but “no one in the world would let us.” In a speech on Monday at the Katif Conference for National Responsibility in the town of Yad Binyamin,…

Every day for two months, Michael Ofer Ziv spent hours watching grainy, black-and-white footage of the Gaza Strip from a tiny room across the border. As an operations commander, he was tracking Israeli forces inside Gaza and approving airstrikes. Every day, he said, his unit had a certain quota to fill. One by…

Hezbollah leader Hassan Nasrallah said his group will respond to Israel “regardless of the consequences” to avenge the assassination of the group’s top commander a week ago, but keeping Israelis waiting is “part of the punishment.” “Their government, their army, their society, their settlements and their occupiers are all waiting,”…

Hamas announced Tuesday that its leader in Gaza, Yahya Sinwar, will replace Ismail Haniyeh as the head of its political bureau, it said in a statement. The Hamas statement said that the movement announces “the selection of Commander Yahya Sinwar as head of the movement’s political bureau, succeeding the martyred…

The market is dropping perilously right now and so it is time to review Bear Market Rules. Today Erin and Carl share their rules for trading during a bear market move. We aren’t officially in a bear market and we may not get there, but there is likely more downside…

On a day when the S&P 500 ($SPX) drops over 200 points at the open, and the Dow Jones Industrial Average ($INDU) and Nasdaq Composite ($COMPQ) drop more than 1,000 points, looking at your portfolio value can be discouraging. But it shouldn’t be. On days like this, there’s more reason…

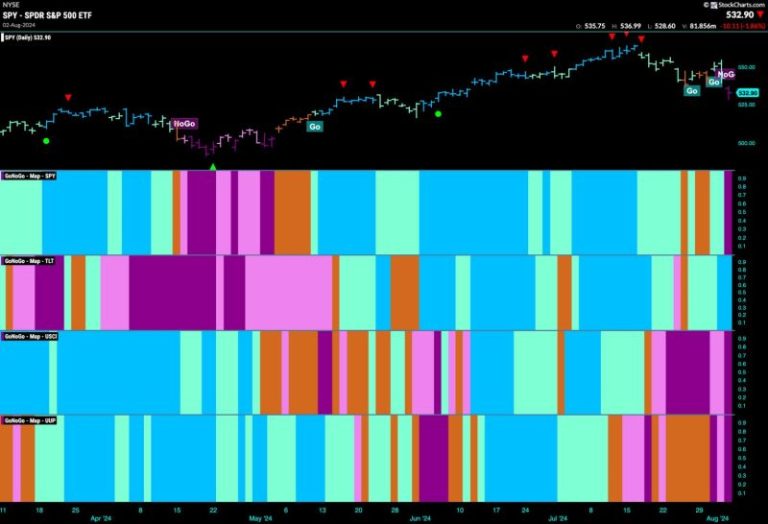

Good morning and welcome to this week’s Flight Path. Equities could not hold onto “Go” colors any longer and we saw a strong purple “NoGo” bar as the trend changed on the last bar of the week. GoNoGo Trend painted strong blue “Go” bars for treasury bond prices while the trend…